More About Life Insurance In Dallas Tx

Wiki Article

Truck Insurance In Dallas Tx Things To Know Before You Get This

Table of Contents4 Easy Facts About Health Insurance In Dallas Tx DescribedThe Best Strategy To Use For Commercial Insurance In Dallas TxThe Facts About Home Insurance In Dallas Tx UncoveredLife Insurance In Dallas Tx - An OverviewThe Best Strategy To Use For Health Insurance In Dallas TxThe Definitive Guide to Home Insurance In Dallas Tx

The costs is the quantity you pay (normally month-to-month) for medical insurance. Cost-sharing describes the section of qualified health care costs the insurance provider pays as well as the part you pay out-of-pocket. Your out-of-pocket expenses might consist of deductibles, coinsurance, copayments as well as the full cost of medical care services not covered by the plan.High-deductible strategies cross categories. Some are PPO strategies while others may be EPO or HMO plans. This type of health and wellness insurance coverage has a high deductible that you need to fulfill prior to your medical insurance coverage works. These plans can be best for individuals that want to conserve money with reduced monthly costs and don't plan to use their medical coverage extensively.

The disadvantage to this sort of protection is that it does not fulfill the minimal essential protection required by the Affordable Treatment Act, so you may likewise be subject to the tax obligation fine. In addition, short-term strategies can omit protection for pre-existing problems. Temporary insurance coverage is non-renewable, as well as does not consist of coverage for preventative treatment such as physicals, vaccines, oral, or vision.

Life Insurance In Dallas Tx Can Be Fun For Anyone

Consult your very own tax, audit, or legal consultant rather than counting on this write-up as tax, audit, or legal suggestions.

You can normally "leave out" any kind of house participant who does not drive your car, yet in order to do so, you need to submit an "exclusion form" to your insurance provider. Chauffeurs who just have a Student's License are not needed to be noted on your plan till they are totally accredited.

Little Known Questions About Truck Insurance In Dallas Tx.

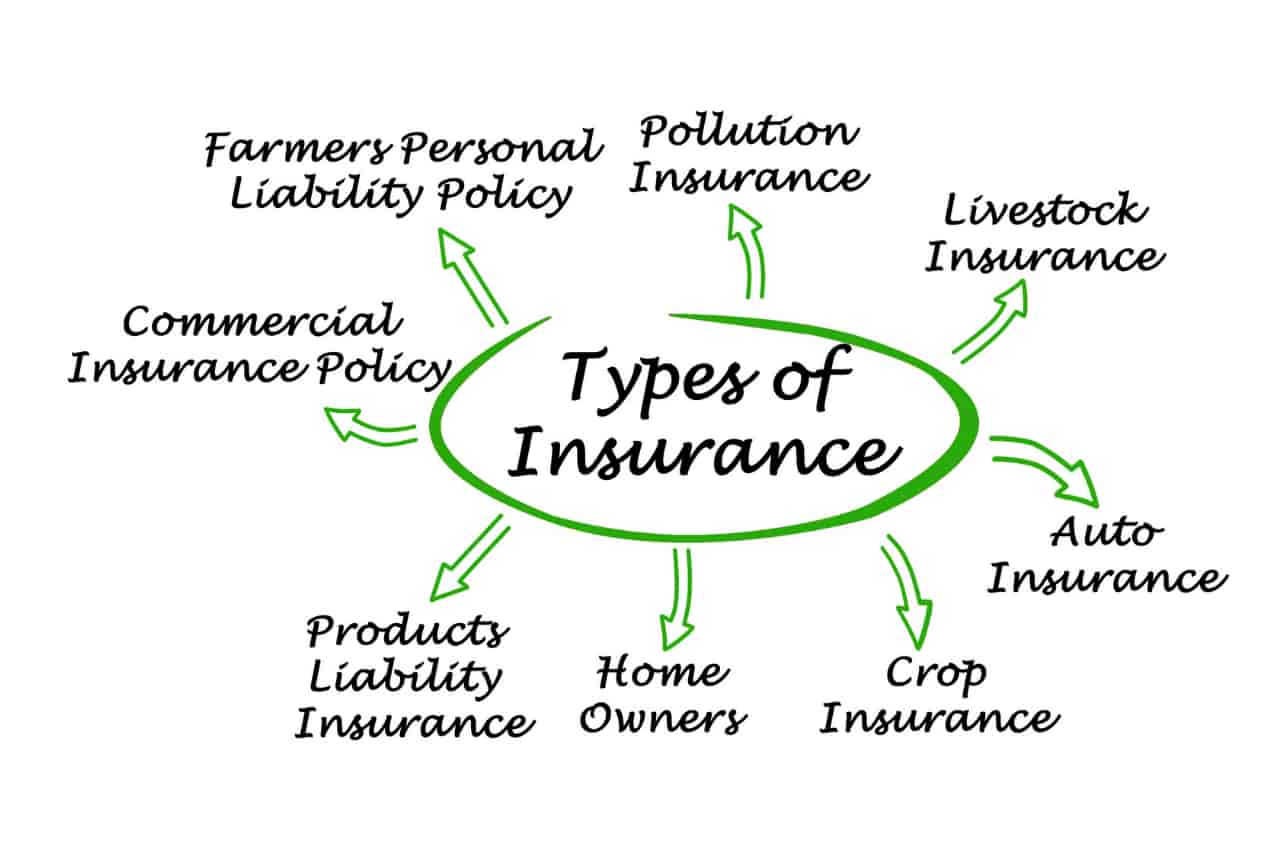

You require to purchase insurance policy to protect yourself, your family members, as well as your riches (Commercial insurance in Dallas TX). An insurance policy might conserve you hundreds of bucks in the event of a mishap, ailment, or calamity. As you strike certain life turning points, some policies, including medical insurance as well as vehicle insurance policy, are virtually required, while others like life insurance policy as well as impairment insurance coverage are highly motivated.Crashes, illness and catastrophes occur regularly. At worst, occasions like these can dive you right into deep financial wreck if you do not have insurance coverage to draw on. Some insurance policies are inevitable (assume: vehicle insurance in a lot of US states), while others are simply a smart financial choice (think: life insurance coverage).

Plus, as your life changes (claim, you obtain a new job or have a baby) so needs to your insurance coverage. Bonuses Below, we've click this clarified briefly which insurance policy coverage you should strongly take into consideration buying at every stage of life. Note that while the policies listed below are set up by age, naturally they aren't ready in stone.

Insurance Agency In Dallas Tx Fundamentals Explained

Here's a brief summary of the policies you need as well as when you require them: A lot of Americans require insurance policy to manage medical care. Picking the strategy that's right for you might take some research study, yet it functions as your very first line of protection against clinical financial debt, among largest resources of financial obligation among customers in the United States.In 49 of the 50 US states, motorists are needed to have car insurance to cover any prospective residential property damage and physical damage that may arise from a crash. Auto insurance coverage rates are largely based on age, credit scores, auto make and also design, driving record and also location. Some states even consider gender.

What Does Truck Insurance In Dallas Tx Do?

An insurer will consider your house's area, as well as the dimension, age and also develop of the house to identify your insurance policy premium. Houses in wildfire-, hurricane- or hurricane-prone locations will often command greater premiums. If you sell your home and return to leasing, or make other living arrangements (Insurance agency in Dallas TX).

For individuals who have a peek at these guys are aging or impaired as well as need assist with day-to-day living, whether in a retirement home or through hospice, lasting treatment insurance policy can help shoulder the exorbitant costs. This is the kind of thing people do not consider until they age and also understand this may be a truth for them, however obviously, as you obtain older you get more expensive to guarantee.

For the many component, there are two sorts of life insurance policy prepares - either term or long-term plans or some mix of both. Life insurers supply different forms of term strategies and also standard life policies along with "rate of interest sensitive" products which have actually ended up being a lot more prevalent since the 1980's.

The Health Insurance In Dallas Tx Diaries

Term insurance provides defense for a given amount of time. This duration might be as brief as one year or give insurance coverage for a certain number of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes up to the oldest age in the life insurance policy mortality tables.The longer the warranty, the greater the preliminary premium. If you pass away during the term duration, the company will pay the face quantity of the policy to your recipient. If you live beyond the term duration you had actually chosen, no advantage is payable. Generally, term policies use a death advantage without cost savings element or money worth.

Report this wiki page